‘WarGames’ Taught Us How to Win the Class War

Between the 1983 Matthew Broderick classic and Choice Taxation, our class war victory is all but guaranteed.

In the nail-biting finale of WarGames — the classic ’80s teen nuclear-war thriller/romance — Matthew Broderick’s character David is trying to stop a supercomputer named WOPR from launching a global nuclear war war that David told it to start. To do this, he instructs WOPR to play tic-tac-toe. The adults are baffled. We’re minutes away from total annihilation and you want to play tic-tac-toe? Seriously?

But getting WOPR to play the game is just David’s way of teaching it that nuclear war, just like tic-tac-toe, is pointless because there’s no way to win, it’s always going to end in a tie. Supercomputer that he is, WOPR catches on quick. It decides to abandon its game of Global Thermonuclear War. The missiles stay put, the world is saved, and WOPR remarks that nuclear war is “A strange game. The only winning move is not to play.”

And that’s how we win the class war.

Somewhere along the way, we bought into the lie that we have no choice but to play the ruling class’s game — a game the Republican-owned-and-operated Supreme Court thoroughly rigged in their favor with its disastrous Citizens United ruling. With that decision, the Court effectively hung a “For Sale” sign around our government’s neck. Corporate America and the filthy rich rushed in to buy it, and ever since, our government has ignored the wants and needs of working people to focus instead on the wishes and whims of the wealthy elite.

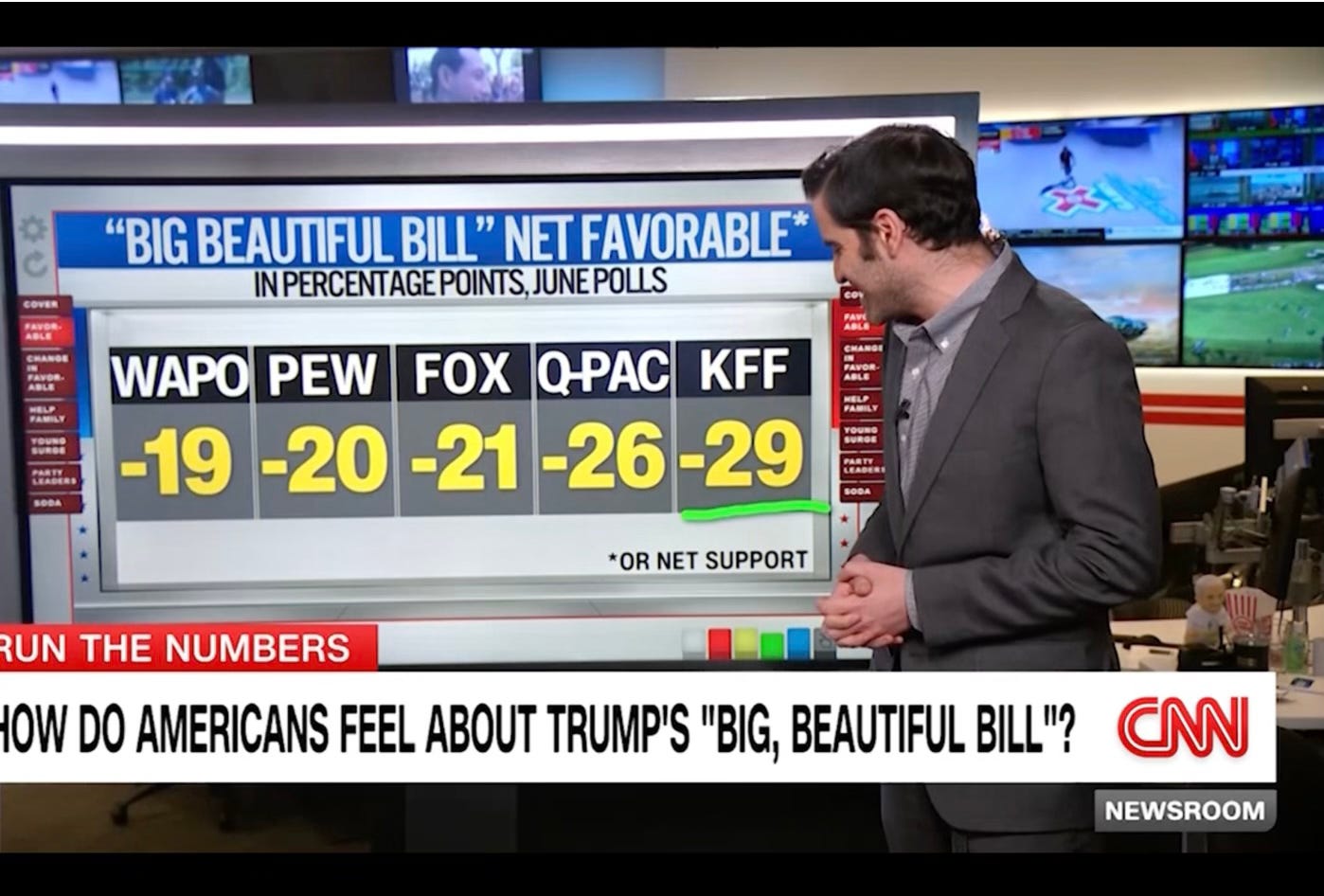

Take, for example, Trump’s so-called “Big Beautiful Bill” — a sweeping piece of legislation he claims will uplift working Americans. Poll after poll shows the majority of Americans think the bill is “awful… horrible… and terrible, terrible, terrible.”

Additionally, only 23% think the bill will help them, while half — 49% — say it will hurt them. But this is hardly surprising, considering the bill is trash. In so many ways, Trump’s Big Beautiful Bill actively harms working people.

Jonathan Larsen provides a brutal summary of just how bad the bill is. Among other things it:

Cuts Medicaid by about $800 billion

Strips health insurance from 16-17 million people

Slashes food assistance to poor families by $285 billion

Forces student loan borrowers to pay on time, every month, for 30 years before qualifying for forgiveness

Closes 27% of nursing homes

Raises electric bills by 10%

Meanwhile, the bill hands ICE over $170 billion — making it the “largest law enforcement agency in the U.S., with a budget bigger than most of the world’s militaries.”

And while it throws in a few token tax breaks for ordinary Americans (like the no-tax-on-tips provision), CNBC reports those are temporary. Tax cuts for the wealthy? Permanent.

The result? The poorest 20% of households lose nearly 4% of their income, while the richest 10% gain over 2%. To put that in perspective: if you make between $1 million and $5 million a year, this bill sends you a $55,300 check. If you make more than $5 million? You get $296,000 — every year.

A strange game indeed.

But here's the good news: this isn’t the only game in town. Choice Taxation is the bold new system that lets us flip the board and start anew.

If you’re unfamiliar with Choice Taxation, you’ll find a detailed guide to it here. But here’s the short version:

Under the plan, our government would end all involvement in education, healthcare, entitlement programs, and the private sector regulations that affect consumers and workers. These critical issues would then be fully governed by these four new partisan tax systems: the Progressive Tax System, the Democrat Tax System, the Republican Tax System, and the MAGA Tax System.

Americans—including individuals, businesses, and corporations — would be free to apply to join the system that best reflects their values. Once accepted, it will be that system, rather than our government, that will collect the majority of our domestic spending tax dollars from us. It will then combine those dollars together with those of our like-minded peers and use them to fund policies and programs rooted in our shared values, beliefs, and policy goals. Thereafter, governmental departments and agencies previously responsible for those issues will be downsized or dissolved.

The key here is the creation of four new partisan tax systems. While Americans will be free to apply to the system of their choice, each system will still have the power to approve or reject applicants as it sees fit. That matters. Because, without access to our labor or our tax dollars, the ruling class will no longer be able to control us.

Even more crucial: since each system will operate independently of our government and one another, those outside a system will have no influence over it. This means billionaires and corporate oligarchs won't get a say in how a system funds its schools, healthcare, or safety net. Nor will they be able to dictate the economic policies that govern the system’s member businesses. Members of the ruling class will be shut out of the systems that don’t want them — and that’s the point. Their absence gives us the freedom to create for ourselves a system that works best for us — not them.

Just like WOPR in WarGames, we’ve been trained to believe that the only option is to keep playing the game — a game we all know is rigged, a game working people have no chance of winning. But Choice Taxation offers us the chance to walk away from the ruling class’s game entirely. We don’t need to fight them on their terms, using their rules, letting their umpires call balls and strikes. We can simply stop playing. Because when the game is this corrupt, truly, the only winning move is not to play.

If you’ve read my About page you know I don’t believe there should be a cover charge for the revolution - so my posts will never go behind a paywall. But if you’d like to support my work and help turn Choice Taxation into a reality, please consider becoming a paid subscriber.

Or if you want to make a one-time contribution to the cause, you can: